Follow Us

10 Street Name, City Name

Country, Zip Code

555-555-5555

myemail@mailservice.com

What Are The Top Small Business Deductions | Tax Tips

Maximizing tax deductions is essential for small business owners aiming to reduce taxable income and enhance profitability. Understanding and leveraging available deductions can lead to significant tax savings. Here are some top small business deductions to consider:

1. Home Office Deduction

If you use a portion of your home exclusively for business purposes, you may qualify for the home office deduction. This allows you to deduct expenses related to that portion, such as mortgage interest, utilities, and insurance. The IRS offers a simplified option, allowing a deduction of $5 per square foot, up to 300 square feet.

2. Business Use of Vehicle

Expenses incurred from using your vehicle for business purposes are deductible. You can choose between the standard mileage rate or actual expenses method. For 2023, the standard mileage rate is 65.5 cents per mile.

3. Office Supplies and Expenses

Costs for office supplies, postage, and other necessary items are fully deductible. Ensure you keep detailed records and receipts for these expenses.

4. Depreciation

The cost of business assets like equipment and furniture can be deducted over time through depreciation. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, up to a certain limit.

5. Salaries and Wages

Compensation paid to employees, including salaries, wages, bonuses, and commissions, is deductible. Ensure compliance with employment tax requirements.

6. Rent Expense

If you rent office space or equipment, those rental payments are deductible as business expenses. This includes co-working spaces and leased equipment.

7. Utilities

Expenses for utilities such as electricity, water, and internet services used for business purposes are deductible. If you operate from home, only the business portion is deductible.

8. Travel Expenses

Business-related travel expenses, including airfare, lodging, and meals, are deductible. Meals are generally 50% deductible, but certain exceptions apply.

9. Advertising and Marketing

Costs associated with promoting your business, such as online advertising, business cards, and promotional materials, are fully deductible.

10. Professional Services

Fees paid to accountants, lawyers, consultants, and other professionals for business services are deductible. This includes costs for tax preparation and legal advice.

11. Insurance

Premiums for business insurance policies, including property, liability, and health insurance for employees, are deductible. This helps protect your business from potential risks.

12. Education and Training

Expenses for courses, workshops, and seminars that improve your business skills are deductible. This includes costs for industry-specific training and certifications.

13. Interest on Business Loans

Interest paid on loans used for business purposes is deductible. Ensure the loan is in the business's name and used for business activities.

14. Retirement Contributions

Contributions to retirement plans for yourself and employees, such as SEP IRAs or 401(k)s, are deductible. This not only provides tax benefits but also aids in employee retention.

15. Bad Debts

If you've included an amount in your income that becomes uncollectible, you may be able to deduct it as a bad debt. This applies to accounts receivable that are no longer collectible.

16. Charitable Contributions

Donations made to qualified charitable organizations are deductible. Ensure you obtain proper documentation for these contributions.

17. Software and Subscriptions

Costs for business-related software and online subscriptions are deductible. This includes accounting software, industry-specific tools, and professional journals.

18. Telephone and Internet Expenses

Expenses for business-related telephone and internet services are deductible. If you use these services for both personal and business purposes, only the business portion is deductible.

19. Moving Expenses

If your business relocates, certain moving expenses may be deductible. This includes costs for transporting equipment and inventory.

20. Startup Costs

Expenses incurred before your business begins operations can be deducted up to $5,000 in the first year, with the remainder amortized over 15 years. This includes costs for market research, advertising, and employee training.

Tips for Maximizing Deductions:

- Maintain Detailed Records: Keep thorough documentation and receipts for all business expenses.

- Separate Personal and Business Expenses: Use separate accounts to avoid commingling funds.

- Consult a Tax Professional: Tax laws are complex and subject to change; professional advice ensures compliance and maximizes deductions.

By understanding and applying these deductions, you can effectively reduce your taxable income and improve your business's financial health.

Enhance Your Business with Professional Marketing Services

While managing your finances is crucial, effectively marketing your business is equally important for growth. At Joshua Lee Bryant - Marketing | SEO | Web Design, we offer comprehensive marketing services to enhance your online presence and drive success. Our marketing services include:

- SEO Services: Boost your visibility and attract more customers with proven strategies that help your business rank on the first page of search results.

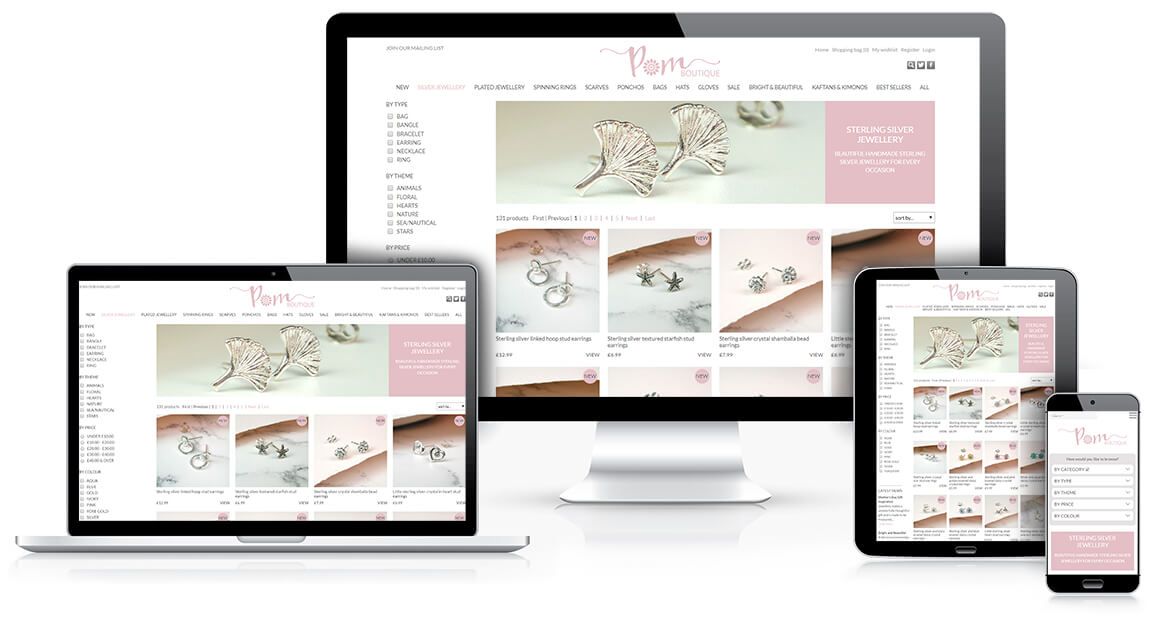

- Web Design Services: Create a stunning, custom-designed website that not only looks great but functions seamlessly across all devices and captures your brand's essence.

- Competitor Analysis Services: Gain insight into how your competitors are succeeding and leverage this knowledge to outperform them.

A well-rounded approach that includes both smart tax strategies and effective marketing can position your business for sustainable growth and success.

To learn more about how I can help your business or for a FREE CONSULTATION, give me a call today: 423-579-3261.

Joshua Lee Bryant

Marketing | SEO | Web Design - Affordable All-In-One Solutions For Small-Large Businesses Looking To Obtain More Customers.

My Services

Digital Marketing

Unlock Your Brand's Potential: Innovative Marketing & Advertising Solutions For Impactful Results.

Local Business Boost

Amplify Your Local Presence: Elevate Your Business to the first page of Google with Our All-In-One SEO Service & Attract More Customers!

Custom Business Websites

Give your Business the Elegant and Engaging Appearance it Deserves online! From Service-Based Businesses to Restaurants, We get the job done so you can focus on what matters!

Ready to Gain the Competitive Edge?

Imagine having an insider’s view of your top competitors’ strategies vs yours, from how they attract customers to how they outperform you everywhere.

Get Your Competitor Analysis Today!

Book a Free Consultation

Ready To Accelerate Your Business To New Heights? I'm here to help. Fill out this form and I will promptly reach out to you for a Free Consultation!

We will get back to you as soon as possible

Please try again later

Joshua Lee Bryant