Follow Us

10 Street Name, City Name

Country, Zip Code

555-555-5555

myemail@mailservice.com

The Best Options For Small Business Expense Tracking

Managing finances efficiently is crucial for the success of any small business. Tracking expenses accurately ensures that you stay on top of your budget, maintain healthy cash flow, and simplify tax season. Luckily, there are a variety of tools available to help small business owners monitor their expenses effectively. Here are some of the best options for small business expense tracking that can simplify your financial management and save valuable time.

1. QuickBooks Online

Best for: Comprehensive Accounting Solutions

QuickBooks Online is one of the most popular expense tracking tools for small businesses. It offers a full suite of accounting features, including expense tracking, invoicing, payroll, and financial reporting. Its user-friendly dashboard allows you to manage all aspects of your finances in one place.

Key Features:

- Real-time expense tracking with bank account integration

- Customizable expense categories and detailed financial reports

- Receipt capture using the mobile app

- Automatic expense categorization

Pros:

- Comprehensive features for small to medium-sized businesses

- Strong customer support and extensive resources

- Cloud-based, allowing access from anywhere

Cons:

- Subscription fees can be higher than some simpler options

2. Wave Financial

Best for: Budget-Conscious Business Owners

Wave Financial offers a free platform that covers expense tracking, invoicing, and accounting. While it might not have all the bells and whistles of premium software, it’s an excellent choice for startups or solo entrepreneurs looking for an effective expense management tool without incurring extra costs.

Key Features:

- Simple expense tracking with bank and credit card integration

- Receipt scanning through a mobile app

- Basic financial reports, such as profit and loss statements

Pros:

- Completely free to use for core features

- User-friendly interface suitable for beginners

Cons:

- Lacks advanced features such as inventory tracking and project management

3. Expensify

Best for: Businesses with Frequent Business Travel

Expensify is designed for small business owners who travel frequently or have employees who do. This app simplifies the process of tracking and reporting expenses, making it easy to scan and log receipts and create expense reports on the go.

Key Features:

- SmartScan technology that reads and records receipt data automatically

- Expense report creation and approval workflows

- Integration with accounting software like QuickBooks and Xero

Pros:

- User-friendly mobile app perfect for on-the-go expense tracking

- Streamlined reporting for easier expense management

Cons:

- Costs can add up if you need advanced features or have multiple users

4. Zoho Expense

Best for: Businesses Already Using Zoho Suite

Zoho Expense is part of the broader Zoho suite of business tools, making it an ideal choice for businesses that already use Zoho products. It offers features such as receipt scanning, multi-currency support, and policy compliance checks.

Key Features:

- Automatic receipt capture and expense categorization

- Multi-currency support for international business expenses

- Integration with other Zoho apps and third-party accounting software

Pros:

- Affordable pricing with scalable plans

- Seamless integration with the Zoho ecosystem

Cons:

- Some advanced features are only available in higher-tier plans

5. FreshBooks

Best for: Service-Based Businesses

FreshBooks is known for its simple and intuitive interface, making it a great option for service-based small businesses that need expense tracking, time tracking, and invoicing capabilities. It automates many financial tasks and helps users keep track of expenses in real-time.

Key Features:

- Bank account integration and automatic expense tracking

- Mobile app for tracking expenses on the go

- Time tracking and project management tools

Pros:

- Easy to use with a clean, intuitive design

- Robust invoicing and time-tracking features

Cons:

- Some users may find it lacking in inventory management features

6. Xero

Best for: Growing Businesses

Xero is an excellent tool for small businesses that anticipate growth. It offers a well-rounded set of features, including expense tracking, payroll, and project management. Xero’s user-friendly design and powerful integrations make it a preferred choice for many small business owners.

Key Features:

- Bank reconciliation and real-time expense tracking

- Customizable expense categories and in-depth financial reporting

- Integration with over 1,000 business apps

Pros:

- Scalable as your business grows

- Multi-currency support and robust integration options

Cons:

- Can be more complex to set up compared to simpler tools

7. Mint

Best for: Sole Proprietors and Freelancers

Mint is a personal finance tool that can also be used by freelancers and sole proprietors to manage business expenses. It’s free and provides basic budgeting and expense tracking capabilities.

Key Features:

- Budget tracking with expense categorization

- Alerts for bill payments and budget limits

- Overview of spending habits and cash flow

Pros:

- Free to use

- Great for individuals who need basic expense management

Cons:

- Not ideal for businesses that need more robust financial tracking

8. Bench

Best for: Business Owners Who Prefer a Hands-Off Approach

Bench is more than just an expense tracker—it’s a full-service bookkeeping solution. With Bench, small business owners can outsource their bookkeeping while staying informed about their expenses and financial health.

Key Features:

- Dedicated bookkeeping team that categorizes expenses for you

- Monthly financial reports with year-end tax support

- Expense tracking integrated with your financial accounts

Pros:

- Relieves the burden of manual expense tracking and bookkeeping

- High-quality service with human support

Cons:

- More expensive than DIY software solutions

Enhance Your Expense Tracking with a Comprehensive Financial Strategy

Tracking expenses is only part of maintaining a successful business. To truly optimize your financial health, consider using my Comprehensive Competitor Analysis Service. This service provides insights into how your top competitors manage and allocate their resources, including their spending on marketing and operational strategies. By understanding where competitors invest their money, you can better plan your budget and expenses.

Benefits of My Competitor Analysis Service:

- Financial Insights: Learn how your competitors are allocating budgets to marketing and operations.

- Strategic Planning: Gain actionable steps to refine your expense tracking and spending strategy.

- Comprehensive Reporting: Access detailed reports that help you make data-driven financial decisions.

To learn more about how I can help your business or for a FREE CONSULTATION, give me a call today: 423-579-3261

Joshua Lee Bryant

Marketing | SEO | Web Design - Affordable All-In-One Solutions For Small-Large Businesses Looking To Obtain More Customers.

My Services

Digital Marketing

Unlock Your Brand's Potential: Innovative Marketing & Advertising Solutions For Impactful Results.

Local Business Boost

Amplify Your Local Presence: Elevate Your Business to the first page of Google with Our All-In-One SEO Service & Attract More Customers!

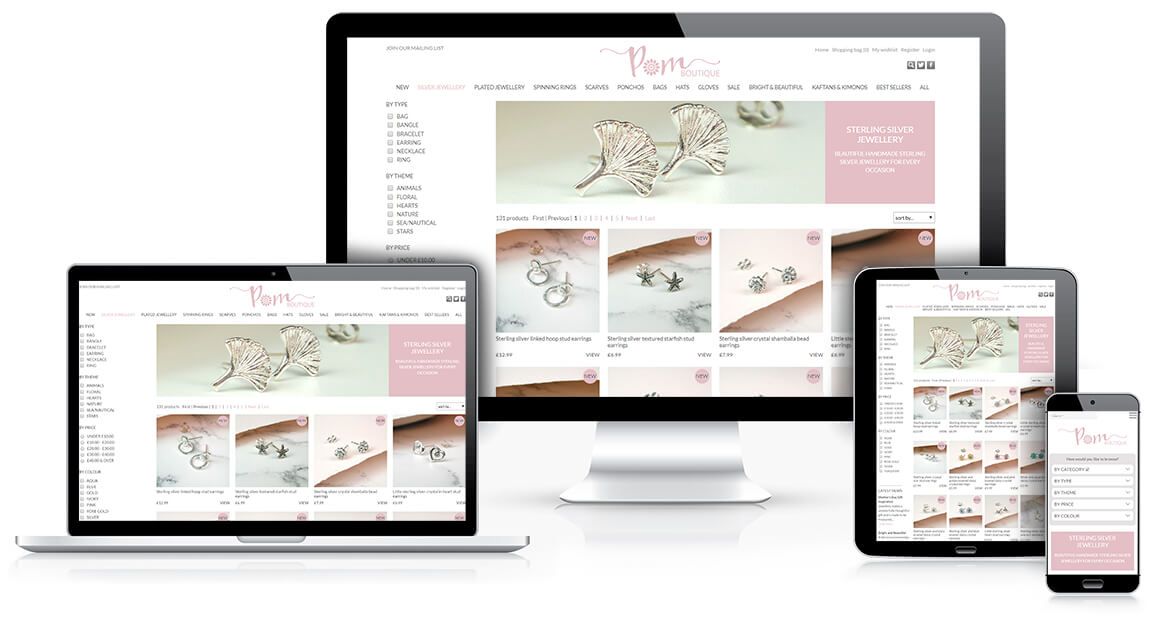

Custom Business Websites

Give your Business the Elegant and Engaging Appearance it Deserves online! From Service-Based Businesses to Restaurants, We get the job done so you can focus on what matters!

Ready to Gain the Competitive Edge?

Imagine having an insider’s view of your top competitors’ strategies vs yours, from how they attract customers to how they outperform you everywhere.

Get Your Competitor Analysis Today!

Book a Free Consultation

Ready To Accelerate Your Business To New Heights? I'm here to help. Fill out this form and I will promptly reach out to you for a Free Consultation!

We will get back to you as soon as possible

Please try again later

Joshua Lee Bryant